Author: logic

During the period of January to May this year, a total of 19,983 individuals were received at the Taxpayer Service Centers of the State Tax Service under the Ministry of Economy of the Nakhchivan Autonomous Republic.

In these centers, 27,120 services were provided related to tax legislation and administration, tax accounting, registration, declarations, current tax payments, and other matters. This represents an increase of 26.8% compared to the same period of the previous year.

86% of the total services were made up of 9 main service types (excluding verbal inquiries and services related to document issuance), including: issuance of the “Asan Imza” certificate;

Submission of declarations (reports) and certificates on the calculation of current tax payments to tax authorities; issuance of receipts for payment of fixed amounts under simplified tax, mandatory state social insurance, and compulsory medical insurance fees; Registration and re-registration of individuals; changes to taxpayer registration data; issuance of certificates to taxpayers; restoration of taxpayer activity; deregistration of individuals; Operations carried out in the electronic information system for employment contracts, etc.

Reference link: https://report.az/biznes-xeberleri/naxcivanda-vergi-odeyicilerine-xidmet-merkezlerinde-gosterilen-xidmetlerin-sayi-27-artib/

At the 29th General Assembly of the Intra-European Organisation of Tax Administrations (IOTA), held in Baku on June 18, B.EST Solutions unveiled its groundbreaking mResidency project — a next-generation platform built on Asan Imza, Azerbaijan’s secure qualified mobile digital signature technology.

The event brought together representatives from over 40 IOTA member countries, alongside international institutions and digital transformation experts. Within the innovation track, B.EST Solutions highlighted how mResidency empowers foreign entrepreneurs and investors to access Azerbaijan’s e-government services remotely and securely, eliminating the need for physical presence and reducing barriers to entry for global business.

The presentation was delivered by Fuad Malikov, Head of Project Operations at B.EST Solutions, to Mr. Orkhan Nazarli, Head of the State Tax Service under the Ministry of Economy of the Republic of Azerbaijan. Mr. Malikov emphasized that mResidency is not only a leap forward in digital identity but a strategic tool to boost Azerbaijan’s attractiveness as a destination for international investment and cross-border operations.

Azerbaijan’s State Tax Service plays a pivotal role in creating a dynamic, transparent, and investor-friendly business environment. Through a series of innovations — including full digitalization of taxpayer services, AI-driven decision support tools, streamlined online business registration, and integrated payment platforms — the Tax Service has become a central actor in simplifying procedures for both local entrepreneurs and global investors.

These reforms have made it easier than ever to start and manage a business remotely, aligning Azerbaijan with global best practices and reinforcing its vision of becoming a leading hub for digital economy and smart governance.

The Asan Imza stand stood alongside global tech giants like Microsoft, Mastercard, NetCompany, Fast Enterprises, and others, underscoring Azerbaijan’s growing prominence in secure mobile identity and digital governance.

B.EST Solutions, as the national operator of Asan Imza, reaffirms its commitment to advancing a secure, inclusive, and internationally connected digital society in line with the country’s long-term innovation strategy.

🔹 mResidency is implemented under a Presidential Decree as part of Azerbaijan’s strategic digital development agenda, under the leadership of the Center for Communication and Analysis of Economic Reforms — a key body driving national innovation and global competitiveness.

Throughout June 18–19, the IOTA technical session featured presentations and discussions on topics such as digital transformation in tax administration, the role of artificial intelligence, taxpayer service improvements, and cross-border collaboration. Member states participated in an innovation exhibition, where they showcase advanced solutions in areas like risk management, HR, communication, and digital infrastructure.

Expressbank is pleased to announce the launch of its new mobile application, “Express Business,” offering a more modern and flexible banking experience for business clients.

With this application, entrepreneurs and company representatives can now manage their financial operations more conveniently and securely — without leaving the office or visiting a bank.

What does the new app offer?

Through the Express Business mobile application, clients will be able to:

- Log in securely using “Asan Imza” – a qualified mobile digital signature

- Quickly switch between accounts for clients managing multiple companies

- Monitor their financial status at any time

- Execute intra-bank, inter-account, and domestic transfers

- Fully control payments and transfers

- Sign documents via mobile device or web platform

- View card and account details, access statements, block or unblock cards

This innovation provides business owners with time savings, operational control, and greater flexibility. The app is available on both iOS and Android platforms and is completely free to use.

Reference link: https://www.expressbank.az/en/news/biznes-musterileri-ucun-tetbiqini-istifadeye-verildi

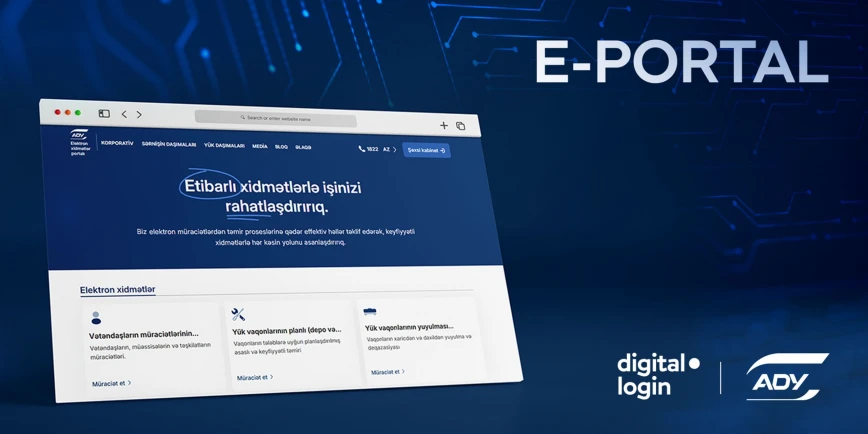

Azerbaijan Railways CJSC has integrated its e-services portal with digital.login, Azerbaijan’s unified national digital identification system.

The development marks an important step in the country’s ongoing digital transformation, improving the accessibility and security of railway services for both citizens and businesses.

The integration was announced via AZCON Holding and reflects close collaboration with the Innovation and Digital Development Agency, which plays a central role in implementing Azerbaijan’s digital governance strategy. Through the updated system, users can now log into the Azerbaijan Railways portal using a variety of state-supported authentication methods, including “Asan Imza” – a qualified mobile digital signature.

According to official communications from the railway operator, the integration is designed to streamline the user experience. Existing users are not required to re-register, removing a common barrier to adoption. The platform offers enhanced login security through verified digital ID credentials, safeguarding access to sensitive services such as ticket purchasing, cargo tracking, and account management.

Reference link: https://idtechwire.com/azerbaijan-railways-links-to-national-digital-id-system-for-enhanced-access/

In March of this year, the Ministry of Labour and Social Protection of the Population added a new feature to the “e-Sosial” portal’s mobile application, enabling employment contracts to be signed electronically.

This new functionality has been well received, and 14,200 employment contracts have been signed electronically through the “e-Sosial” mobile application during the period since its launch.

Once an employment contract is submitted by the employer for approval, it appears in the “Employment Contract Signing” section on the main screen of the citizen’s mobile app.

Citizens can conveniently sign these contracts electronically — including by using the “Asan Imza” qualified mobile digital signature.

This innovation not only accelerates the digitalization of labor relations but also makes the signing process faster and more accessible for citizens.

Reference link: https://azertag.az/xeber/e_sosial_mobil_tetbiqi_vasitesile_elektron_qaydada_142_min_emek_muqavilesi_imzalanib-3544551

Reference link: https://valyuta.az/az/read/69229/

Starting from April 1, legal and physical persons engaged in passenger transportation by motor vehicles will be issued a “Distinction Sign” and “Special Distinction Sign” only online via the portal https://e-xidmet.ayna.gov.az.

The process will be carried out through the “Distinction Sign” sub-system integrated into the “AYNA” information system. Applications for obtaining a “Distinction Sign” via this system can only be submitted using the “Asan Imza” qualified mobile digital signature.

Considering that the system is new, “User Guides” have been prepared to minimize any potential questions.

It has been noted that, according to the legislation, a fine of 40 AZN is stipulated for passenger transportation by motor vehicles without a Distinction Sign.

Reference link: https://news.day.az/azerinews/1736868.html

The use of electronic signature tools through the “Digital Login” system will be introduced in the “Submission of Official Statistical Reports” e-service of the State Statistical Committee.

According to the Committee, this change is part of measures aimed at ensuring the confidentiality of initial data submitted by legal entities and individuals for official statistical purposes. Beginning March 2025, electronic signatures from the “Digital Login” system — including the “Asan Imza” qualified mobile digital signature — will be required when using the “Submission of Official Statistical Reports” e-service.

As a transition period, until July 2025, it will still be possible to submit official statistical reports using the current method — i.e., logging into the system with a code and password. However, once the transition phase ends, submissions via code and password will no longer be accepted (excluding branches and representative offices subordinate to legal entities).

The Committee notes: “Taking this into consideration, we kindly request you to begin preparations for the timely submission of official statistical reports using an electronic or Asan Imza signature. After the reporting deadline for the official statistical reports that must be submitted by a legal or physical person based on their field of activity, access to the electronic system will be blocked, and submission will no longer be possible. If the required data for statistical observations is not submitted or is submitted late, in accordance with Article 389 of the Code of Administrative Offenses of the Republic of Azerbaijan, individuals responsible will be subject to an administrative fine ranging from 300 to 500 AZN.”

Reference link: https://banker.az/statistika-hesabatlarinin-t%C9%99qdim-edilm%C9%99sind%C9%99-elektron-imza-t%C9%99tbiq-edil%C9%99c%C9%99k/

Over 631,000 Individuals Were Served at Taxpayer Service Centers in Azerbaijan Last Year

In 2024, a total of 631,320 individuals were served at taxpayer service centers in Azerbaijan, according to the State Tax Service under the Ministry of Economy, as reported by https://az.shafaqna.com/

During this period, 960,265 services were provided, including:

- Over 353,000 oral consultations, addressing taxpayers’ inquiries about tax legislation and administration.

- Over 88,300 electronic services, which assisted with preparing and submitting declarations, reports, and other applications in electronic format.

Key Service Types

Approximately 90.9% of the total services were concentrated in 10 main categories (excluding oral consultations and ready document services):

- Submission of declarations (reports) and statements on current tax payments to tax authorities.

- Suspension of taxpayer activities.

- Issuance of receipts for simplified tax fixed payments, mandatory state social insurance, and compulsory health insurance contributions.

- Issuance of “Asan Imza” certificates.

- Registration and re-registration of individual taxpayers.

- Changes to taxpayer registration data.

- Issuance of references to taxpayers.

- Deregistration of individual taxpayers.

- Registration (and deregistration) of taxpayers’ business units (facilities).

Written Inquiries and Notifications

- More than 35,200 written inquiries from taxpayers were responded to during the reporting period.

- Over 13.1 million informational notifications (letters) of various types were sent to taxpayers.

Meetings and Targeted Services

- 306 meetings were held with the participation of 4,268 taxpayers.

- 5,586 taxpayers received targeted services.

- To ensure preventive awareness, over 2 million SMS messages were sent to taxpayers’ mobile numbers.

The State Tax Service continues to prioritize providing high-quality, transparent, and accessible services to taxpayers.

In recent years, there has been an increase in cases where citizens are deceived, and legal entities are established in their names through the unauthorized use of electronic signatures and powers of attorney. Analysis shows that in many cases, legal entities are created in the names of citizens without their consent or knowledge.

The State Tax Service informed that such incidents often lead to illegal entrepreneurial activities and the accumulation of tax debts.

It was noted that an electronic signature is a tool of legal significance that confirms a citizen’s identity in a digital environment. In Azerbaijan, digital signatures such as Asan Imza ( qualified mobile digital signature) and other electronic signatures are widely used. These signatures are essential for accessing government services, verifying various documents, and conducting business transactions. However, unfortunately, the misuse of these signatures for fraudulent purposes has become more common.

Investigations conducted by the State Tax Service reveal that, in some cases, citizens are deceived, and their electronic signatures are misused. Additionally, powers of attorney are obtained in their names, or they are enticed into participating in unlawful transactions. In many cases, citizens remain unaware of the responsibilities associated with the documents they sign. Such actions lead to the establishment of legal entities, transactions conducted in their names, and significant tax debts owed to the state budget. Since the citizen is legally considered the owner of the electronic signature, they are held accountable for settling the debts and bearing the consequences of transactions carried out using their signature.

The State Tax Service has issued a serious warning, particularly regarding the delegation of entrepreneurial powers to third parties. A power of attorney is a document granting one person certain rights on behalf of another. At the same time, citizens should exercise caution with their enhanced electronic signatures. An electronic signature is personal to its owner, and the owner is responsible for safeguarding it. It must not be allowed to be used by others.

Every citizen must understand the legal responsibilities associated with the powers granted by an electronic signature. This understanding helps prevent potential legal issues in the future. If citizens encounter fraudulent activities or unauthorized transactions involving their electronic signature, they must immediately report the matter to law enforcement agencies and the relevant state bodies to suspend the validity of the signature.